License and Bonding Requirements for Motor Fuel Distributors

Do I need a license to buy and sell fuel in Montana?

- License is NOT required if buying/selling tax-paid fuel in Montana.

- License is REQUIRED if you:

- Produce, refine, manufacture, or compound gasoline/special fuel for use, or distribution; or

- Import from another state or province;

- Export fuel from Montana to another state or province;

- Engage in the business of wholesale distribution to retail outlets you do not own and CHOOSES to become licensed to assume the Montana state gasoline and/or special fuel tax liability. See ARM 18.15.210 and 18.15.211

What are the Bonding Requirements?

- Required bond is up to 2× estimated monthly tax liability.

- Minimum bond for Importers and/or Exporters: $25,000.

- Maximum bond required by law: $100,000.

Please note that the review, processing, and issuance of your license may take up to four weeks. We recommend planning accordingly to ensure you have a valid license prior to starting your fuel business.

Questions?

Please contact: 406-444-7276 Email:

Applying for a Montana Motor Fuel Distributor License

How to Apply for a License?

- Completed Application for Gasoline/Special Fuel Distributor License

- Wholesaler Supplemental Form (if applicable)

- Surety Bond- In the initial amount of $25,000 for importers and/or exporters or 2 times the estimated monthly fuel tax liability.

- Purchase/Sale Agreement showing the distributor has business in Montana.

- Montana Department of Transportation will verify applicant is in good standing with relevant states and jurisdictions after receiving all required documents per MCA 15-70-402(2).

Do I qualify as a “Wholesaler”?

- Do you supply fuel to retail locations that you do not own?

- Yes – Complete the Wholesaler Supplemental Form.

- No - You do not qualify as a “Wholesaler” in Montana

How do I Submit the Required documents?

We offer the following secure options for submitting your information:

- Mail all required documentation to:

2701 Prospect Ave

PO Box 201001

Helena MT 59620-1001M - Fax: 1-406-444-5411

- State of Montana’s File Transfer Service

To use the File Transfer Service, visit: https://transfer.mt.gov/Home/Login

When using the File Transfer Service, please send your files to:mdtfueltaxXYZmtABCgov (listed as "MDT Fuel Tax " within the service).

Distributor Fuel Tax Return Due Dates

| Reporting Period | Report Due | Check payment must be postmarked by: | EFT Payment Due | ACH Draft Date |

|---|---|---|---|---|

| September 2025 | 10/27/2025 | 10/27/2025 | 10/30/2025 | 10/30/2025 |

| October 2025 | 11/25/2025 | 11/25/2025 | 12/1/2025 | 12/1/2025 |

| November 2025 | 12/26/2025 | 12/26/2025 | 12/30/2025 | 12/30/2025 |

| December 2025 | 1/26/2026 | 1/26/2026 | 1/30/2026 | 1/30/2026 |

| January 2026 | 2/25/2026 | 2/25/2026 | 3/2/2026 | 3/2/2026 |

| February 2026 | 3/25/2026 | 3/25/2026 | 3/30/2026 | 3/30/2026 |

| March 2026 | 4/27/2026 | 4/27/2026 | 4/30/2026 | 4/30/2026 |

| April 2026 | 5/26/2026 | 5/26/2026 | 6/1/2026 | 6/1/2026 |

| May 2026 | 6/25/2026 | 6/25/2026 | 6/30/2026 | 6/30/2026 |

| June 2026 | 7/27/2026 | 7/27/2026 | 7/30/2026 | 7/30/2026 |

| July 2026 | 8/25/2026 | 8/25/2026 | 8/31/2026 | 8/31/2026 |

| August 2026 | 9/25/2026 | 9/25/2026 | 9/30/2026 | 9/30/2026 |

| September 2026 | 10/26/2026 | 10/26/2026 | 10/30/2026 | 10/30/2026 |

| October 2026 | 11/25/2026 | 11/25/2026 | 11/30/2026 | 11/30/2026 |

| November 2026 | 12/28/2026 | 12/28/2026 | 12/30/2026 | 12/30/2026 |

| December 2026 | 1/26/2027 | 1/26/2027 | 1/30/2027 | 1/30/2027 |

*Tax reports for the preceding month are due and need to be postmarked by the 25th of the month except when the 25th falls on a weekend or holiday. When this happens, the due date becomes the next business day after the 25th. For example, September 2025 reports are due and must be postmarked on or before October 27, 2025. A report must be filed regardless of fuel activity.

* Incentive to pay electronically: Montana offers electronic tax payments made either by ACH Credit or ACH Debit. If you pay your taxes by one of these methods, the due date for the tax payment is 5 days after the 25th. When that 5th day falls on a weekend or holiday, the due date becomes the first business day after that 5th day. The due date for the tax report remains the same regardless of how payment of tax is made.

Motor Fuel Distributor Tax Return Filing

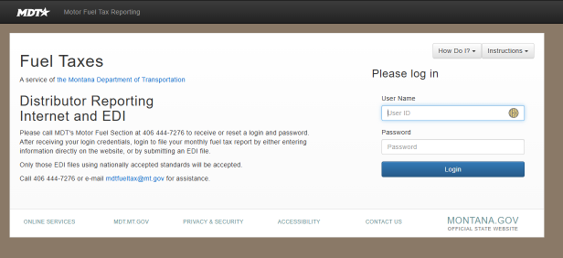

How do I file the tax return?

- You can file your monthly tax return online by entering information directly into the Montana Motor Fuel Tax Reporting system or by submitting an EDI file.

https://app.mdt.mt.gov/fuelweb

*You will receive your username and temporary password and filing guidelines once you have an active license.

Montana Gasoline/Special Fuel Distributors monthly paper reporting forms are available on the Internet at http://www.mdt.mt.gov/publications/forms.aspx. All information on the schedules is required. All distributors receiving over 99,999 gallons of fuel in a 12-month period are required to report electronically.

Motor Fuel Distributor License FAQ’s

What is the purpose of a distributor’s license?

In Montana, the taxation point of gasoline, aviation fuel and diesel fuel is “at distributor level”. This means the licensed distributor is the collector of the state tax for MDT. The license allows the distributor to purchase fuel at the terminal without the tax and cleanup fee included in the price. Terminals, Refineries, Blenders, and Importers are required to have the license because they have access to fuel that has not yet been taxed (from the pipeline, by producing fuel, and by importing from another state). Licensed exporters buy the fuel in Montana and then leave the state.

Do I need a separate license for each type of fuel I want to distribute?

No. A distributor needs only one license. The tax reporting form includes all fuel types that are taxable.

Do I need a separate license to import or export?

No. Once a person qualifies as a distributor, the distributor is able to engage in all the activities defined for a distributor. MCA 15-70-401(8) (a) (ii) and (14) and (15)

If the tax is $0.33 on gas and $0.2975 for special fuel, why does the distributor pay $0.3267 on gas and $0.2945 on special fuel?

All licensed distributors receive a collection allowance in the amount of 1% on gasoline and special fuel. There is no collection fee on aviation fuel. MCA 15-70-410(1)

Do I have to re-license every year?

No. The license is good until canceled or revoked.

Is there a fee to become licensed?

No.

Motor Fuel Distributor Reporting FAQ’s

If I have a problem and am not able to file a tax return on the due date, am I allowed an extension to pay the tax due or file my report?

No. There is no provision in the law for an extension of either paying the taxes or filing a tax report. There have been some instances where a distributor had problems with their computers. The best thing to do is estimate the best you can and pay and file on the due dates. Distributors can amend their reports and can get credit they have overpaid. MCA 15-70-410; and 15-70-425.

What is the penalty for late filing and/or late payment?

The late filing penalty is $100.00. The first late filing penalty within a 3-year period may be waived if a distributor has a clean filing history. MCA 15-70-417(3)(a)

Late payment of tax is charged 10% penalty on the balance owing and bears interest at the rate of 1% on the tax due for each calendar month prorated daily. MCA 15-70-417. There is no waiver of penalty or interest on a late payment of tax.

Can I buy clear fuel then add dye to be exempt from tax?

No. To be exempt from the tax, diesel must be injected with dye at a refinery or terminal. MCA 15-70-403; See ARM 18.15.504 (6).

Who is exempt from paying the Gasoline license tax?

Licensed distributors pay the gasoline license tax to the Department of Transportation. The motor fuel tax is then passed down to the customer or ultimate consumer. There are no exemptions for paying the gasoline tax. However, the gasoline tax may be subject to refund or credit if conditions are met as stated in MCA 15-70-425.

Who is exempt from paying the Special Fuel license tax?

SEE DYED SPECIAL FUEL

Licensed distributors pay the special fuel license tax to the Department of Transportation. The motor fuel tax is then passed down to the customer or ultimate consumer. City, state and federal governments may use untaxed dyed special fuel upon public roads or may apply for a refund of the taxes paid on special fuel regardless of the use of the special fuel. MCA 15-70-425 and ARM 18.15.503

Who is exempt from paying the Aviation Fuel license tax?

Only those gallons of JP4 or JP8 (jet fuel) that are sold directly to the Military Defense Fuel Supply Center are exempt from the total .04 tax. MCA 15-70-403 (1) (c)

What are the consequences of importing fuel into MT without a license?

Failure to obtain a Montana Gasoline/Special Fuel Distributor License as required, subjects the distributor to the provisions of MCA 15-70-419 allowing for the seizure, confiscation, and possible forfeiture of the fuel.